Page 64 - Energize January 2022

P. 64

TECHNICAL

increased between 2010 and 2014, as

projects shifted further offshore into

deeper waters and started using the

latest multi-megawatt (MW) designs.

They then reached a peak before

declining, with the LCOE down 33%

between 2014 and 2019, from $0,183/

kWh to $0,115/kWh. The largest decline

was between 2015 and 2016 – 14% –

and then between 2018 and 2019, by

10%. The factors driving this trend were

identical to those driving installed costs

and capacity factors and were driven by

learning-by doing, supply chain dynamics

and – indirectly – by learning-by-RD&D.

An increase in capacity factors was

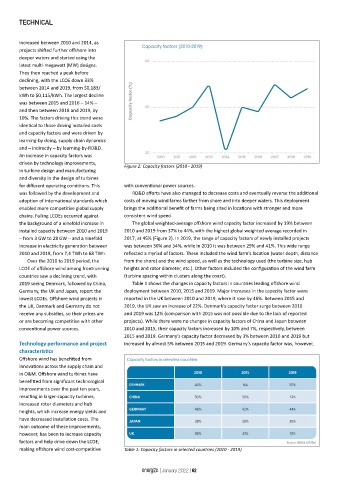

driven by technology improvements, Figure 2: Capacity factors (2010 - 2019)

in turbine design and manufacturing

and diversity in the design of turbines

for different operating conditions. This with conventional power sources.

was followed by the development and RD&D efforts have also managed to decrease costs and eventually reverse the additional

adoption of international standards which costs of moving wind farms farther from shore and into deeper waters. This deployment

enabled more competitive global supply brings the additional benefit of farms being sited in locations with stronger and more

chains. Falling LCOEs occurred against consistent wind speed.

the background of a ninefold increase in The global weighted-average offshore wind capacity factor increased by 19% between

installed capacity between 2010 and 2019 2010 and 2019 from 37% to 44%, with the highest global weighted average recorded in

– from 3 GW to 28 GW – and a ninefold 2017, at 45% (Figure 2). In 2019, the range of capacity factors of newly installed projects

increase in electricity generation between was between 30% and 54%, while in 2010 it was between 29% and 41%. This wide range

2010 and 2018, from 7,4 TWh to 68 TWh. reflected a myriad of factors. These included the wind farm’s location (water depth, distance

Over the 2010 to 2019 period, the from the shore) and the wind speed, as well as the technology used (the turbine size, hub

LCOE of offshore wind among frontrunning heights and rotor diameter, etc.). Other factors included the configuration of the wind farm

countries saw a declining trend, with (turbine spacing within clusters along the coast).

2019 seeing Denmark, followed by China, Table 1 shows the changes in capacity factors in countries leading offshore wind

Germany, the UK and Japan, report the deployment between 2010, 2015 and 2019. Major increases in the capacity factor were

lowest LCOEs. Offshore wind projects in reported in the UK between 2010 and 2019, where it rose by 46%. Between 2015 and

the UK, Denmark and Germany do not 2019, the UK saw an increase of 22%. Denmark’s capacity factor surge between 2010

receive any subsidies, so their prices are and 2019 was 12% (comparison with 2015 was not possible due to the lack of reported

or are becoming competitive with other projects). While there were no changes in capacity factors of China and Japan between

conventional power sources. 2010 and 2015, their capacity factors increased by 10% and 7%, respectively, between

2015 and 2019. Germany’s capacity factor decreased by 3% between 2010 and 2019 but

Technology performance and project increased by almost 5% between 2015 and 2019. Germany’s capacity factor was, however,

characteristics

Offshore wind has benefitted from

innovations across the supply chain and

in O&M. Offshore wind turbines have

benefitted from significant technological

improvements over the past ten years,

resulting in larger-capacity turbines,

increased rotor diameters and hub

heights, which increase energy yields and

have decreased installation costs. The

main outcome of these improvements,

however, has been to increase capacity

factors and help drive down the LCOE,

making offshore wind cost-competitive Table 1: Capacity factors in selected countries (2010 - 2019)

energize | January 2022 | 62