Page 8 - Energize October 2022

P. 8

INDUSTRY NEWS

address its role in climate change. As Meanwhile, countries continued to complete constructions of new coal plants in

the global economy recovers from the 2021, and coal still accounts for the single largest share of global capacity at 27%. One

Covid-19 pandemic, electricity demand small bright spot: the speed at which new coal is being added to the grid is slowing. Just

surged 5,6% year-on-year, putting new 13 GW of new coal-fired capacity was completed in 2021, down from 31 GW in 2020 and

strains on existing infrastructure and fossil 83 GW in 2012.

fuel supply chains. Nonetheless, the result was a commensurate 7% spike in global CO 2 emissions from

Lower-than-expected production from the power sector in 2021 compared to 2020. Power-sector emissions set a new high at

hydro plants and higher natural gas prices 13 600 Mt of CO 2, BNEF estimates.

also helped put coal-fired power back in “It was a year of highs and highs, for the best and worst reasons,” said Ethan Zindler,

the spotlight in more markets. Production head of Americas at BNEF. “Renewables grew very fast, but coal’s comeback and the fact

from coal plants set records by jumping that countries – including those that have pledged to achieve net-zero emissions – continue

8,5% from 2020-2021 (up 750 TWh on a building coal is really disconcerting.”

net basis), to 9600 TWh. Over 85% of that

generation came from ten countries, with Contact Veronika Henze, BloombergNEF, vhenze@bloomberg.net,

China, India and the US alone accounting https://www.bloomberg.org/

for 72%. Follow Bloomberg on Facebook, Instagram, YouTube, Twitter, and LinkedIn

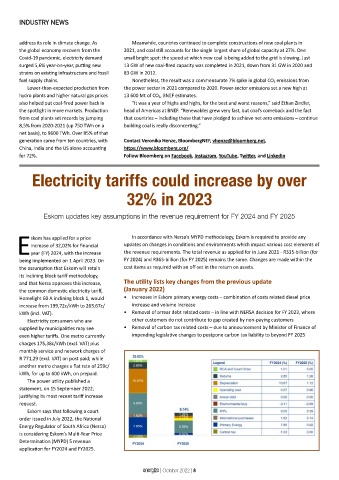

Electricity tariffs could increase by over

32% in 2023

Eskom updates key assumptions in the revenue requirement for FY 2024 and FY 2025

skom has applied for a price In accordance with Nersa’s MYPD methodology, Eskom is required to provide any

increase of 32,02% for financial updates on changes in conditions and environments which impact various cost elements of

Eyear (FY) 2024, with the increase the revenue requirements. The total revenue as applied for in June 2021 - R335-billion (for

being implemented on 1 April 2023. On FY 2024) and R365-billion (for FY 2025) remains the same. Changes are made within the

the assumption that Eskom will retain cost items as required with an off-set in the return on assets.

its inclining block tariff methodology,

and that Nersa approves this increase, The utility lists key changes from the previous update

the common domestic electricity tariff, (January 2022)

Homelight 60 A inclining block 1, would • Increases in Eskom primary energy costs – combination of costs related diesel price

increase from 199,72c/kWh to 263,67c/ increase and volume increase

kWh (incl. VAT). • Removal of arrear debt related costs – in line with NERSA decision for FY 2023, where

Electricity consumers who are other customers do not contribute to gap created by non-paying customers

supplied by municipalities may see • Removal of carbon tax related costs – due to announcement by Minister of Finance of

even higher tariffs. One metro currently impending legislative changes to postpone carbon tax liability to beyond FY 2025

charges 175,38c/kWh (excl. VAT) plus

monthly service and network charges of

R 771,29 (excl. VAT) on post paid; while

another metro charges a flat rate of 259c/

kWh, for up to 600 kWh, on prepaid.

The power utility published a

statement, on 15 September 2022,

justifying its most recent tariff increase

request.

Eskom says that following a court

order issued in July 2022, the National

Energy Regulator of South Africa (Nersa)

is considering Eskom’s Multi-Year Price

Determination (MYPD) 5 revenue

application for FY2024 and FY2025.

energize | October 2022 | 8