Page 6 - Blue Valley News August/September 2021

P. 6

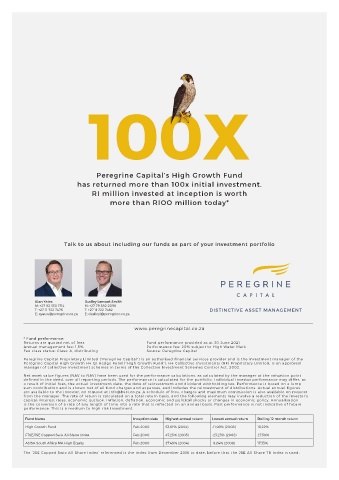

Peregrine Capital’s High Growth Fund

has returned more than 100x initial investment.

RI million invested at inception is worth

more than RIOO million today*

Talk to us about including our funds as part of your investment portfolio

Alan Yates Dudley Lamont Smith

M: +27 82 330 1714 M: +27 79 582 2096

T: +27 11 722 7476 T: +27 11 722 7482 DISTINCTIVE ASSET MANAGEMENT

E: ayates@peregrine.co.za E: dudleyl@peregrine.co.za

www.peregrinecapital.co.za

* Fund performance:

Returns are quoted net of fees Fund performance provided as at 30 June 2021

Annual management fee: 1.5% Performance fee: 20% subject to High Water Mark

Fee class status: Class: A, distributing Source: Peregrine Capital

Peregrine Capital Proprietary Limited (“Peregrine Capital”) is an authorised financial services provider and is the investment manager of the

Peregrine Capital High Growth H4 QI Hedge Fund (“High Growth Fund”). H4 Collective Investments (RF) Proprietary Limited, is an approved

manager of collective investment schemes in terms of the Collective Investment Schemes Control Act, 2002.

Net asset value figures (NAV to NAV) have been used for the performance calculations, as calculated by the manager at the valuation point

defined in the deed, over all reporting periods. The performance is calculated for the portfolio. Individual investor performance may differ, as

a result of initial fees, the actual investment date, the date of reinvestment and dividend withholding tax. Performance is based on a lump

sum contribution and is shown net of all fund charges and expenses, and includes the reinvestment of distributions. Actual annual figures

are available to the investor, on request at info@h4ci.co.za. A schedule of fees, charges and maximum commission is also available on request

from the manager. The rate of return is calculated on a total return basis, and the following elements may involve a reduction of the investor’s

capital: interest rates, economic outlook, inflation, deflation, economic and political shocks or changes in economic policy. Annualisation

is the conversion of a rate of any length of time into a rate that is reflected on an annual basis. Past performance is not indicative of future

performance. This is a medium to high risk investment.

Fund Name Inception datee Highest annual return Lowest annual return Rolling 12 month return

High Growth Fund Feb 2000 53.01% (2004) -11.98% (2008) 18.22%

FTSE/JSE Capped Swix All Share Index Feb 2000 47.25% (2005) -23.23% (2008) 27.59%

ASISA South Africa MA High Equity Feb 2000 27.49% (2004) -8.24% (2008) 17.33%

The ‘JSE Capped Swix All Share Index’ referenced is the index from December 2016 to date, before that the JSE All Share TR Index is used.

4 • Issue 4 2021 • BLUE VALLEY NEWS