Page 24 - Waterfall City_Issue 11_2022

P. 24

Waterfall City News

legacy make a consoling gift to their

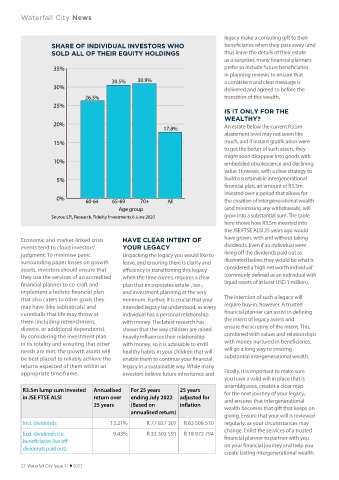

SHARE OF INDIVIDUAL INVESTORS WHO beneficiaries when they pass away (and

SOLD ALL OF THEIR EQUITY HOLDINGS thus leave the details of their estate

as a surprise), many financial planners

35% prefer to include future beneficiaries

in planning reviews to ensure that

30.5% 30.9% a consistent and clear message is

30% delivered and agreed to before the

26.3% transition of this wealth.

25%

IS IT ONLY FOR THE

WEALTHY?

20% An estate below the current R3.5m

17.8%

abatement level may not seem like

15% much, and if instant gratification were

to get the better of such assets, they

might soon disappear into goods with

10% embedded obsolescence and declining

value. However, with a clear strategy to

5% build a sustainable intergenerational

financial plan, an amount of R3.5m

invested over a period that allows for

0% 60-64 65-69 70+ All the creation of intergenerational wealth

Age group (and minimising any withdrawals), will

Source: LPL Research, Fidelity Investments 6 June 2020 grow into a substantial sum. The table

here shows how R3.5m invested into

the JSE FTSE ALSI 25 years ago would

Economic and market-linked crisis HAVE CLEAR INTENT OF have grown, with and without taking

events tend to cloud investors’ YOUR LEGACY dividends. Even if an individual were

judgment. To minimise panic Unpacking the legacy you would like to living off the dividends paid out as

surrounding paper losses on growth leave, and ensuring there is clarity and illustrated below, they would be what is

assets, investors should ensure that efficiency in transitioning this legacy considered a ‘high net worth individual’

they use the services of an accredited when the time comes, requires a clear (commonly defined as an individual with

financial planner to co-craft and plan that incorporates estate-, tax-, liquid assets of at least USD 1 million).

implement a holistic financial plan and investment planning at the very

that also caters to other goals they minimum. Further, it is crucial that your The intention of such a legacy will

may have (like sabbaticals) and intended legacy be understood, as every require buy-in, however. A trusted

curveballs that life may throw at individual has a personal relationship financial planner can assist in defining

them (including retrenchment, with money. The latest research has the intent of legacy assets and

divorce, or additional dependents). shown that the way children are raised ensure the scrutiny of the intent. This,

By considering the investment plan heavily influences their relationship combined with values and relationships

in its totality and ensuring that other with money, so it is advisable to instil with money nurtured in beneficiaries,

needs are met, the growth assets will healthy habits in your children that will will go a long way to creating

be best placed to reliably achieve the enable them to continue your financial substantial intergenerational wealth.

returns expected of them within an legacy in a sustainable way. While many

appropriate time frame. investors believe future inheritance and Finally, it is important to make sure

you have a valid will in place that is

unambiguous, creates a clear map

R3.5m lump sum invested Annualised For 25 years 25 years for the next journey of your legacy,

in JSE FTSE ALSI return over ending July 2022 adjusted for and ensures that intergenerational

25 years (Based on inflation wealth becomes that gift that keeps on

annualised return)

giving. Ensure that your will is reviewed

Incl. dividends 13.21% R 77 837 307 R 63 508 510 regularly, as your circumstances may

change. Enlist the services of a trusted

Excl. dividends (i.e. 9.43% R 33 302 591 R 18 973 794

beneficiaries live off financial planner to partner with you

dividends paid out) on your financial journey and help you

create lasting intergenerational wealth.

22 Waterfall City Issue 11 2022