Page 11 - Intra Muros October Issue 2025

P. 11

Live the life, love the home www.ikonic.co.za

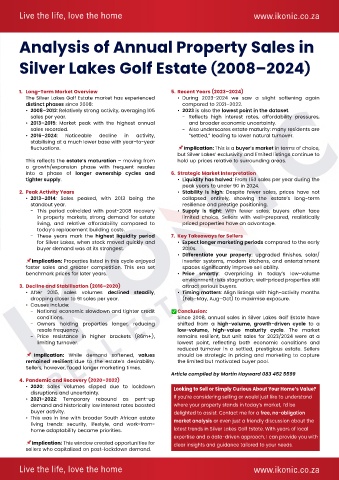

Analysis of Annual Property Sales in

Silver Lakes Golf Estate (2008–2024)

1. Long-Term Market Overview 5. Recent Years (2023–2024)

The Silver Lakes Golf Estate market has experienced • During 2023-2024 we saw a slight softening again

distinct phases since 2008: compared to 2021–2022.

• 2008–2012: Relatively strong activity, averaging 105 • 2023 is also the lowest point in the dataset.

sales per year. - Reflects high interest rates, affordability pressures,

• 2013–2015: Market peak with the highest annual and broader economic uncertainty.

sales recorded. - Also underscores estate maturity: many residents are

• 2016–2024: Noticeable decline in activity, “settled,” leading to lower natural turnover.

stabilising at a much lower base with year-to-year

fluctuations. Implication: This is a buyer’s market in terms of choice,

but Silver Lakes’ exclusivity and limited listings continue to

This reflects the estate’s maturation – moving from hold up prices relative to surrounding areas.

a growth/expansion phase with frequent resales

into a phase of longer ownership cycles and 6. Strategic Market Interpretation

tighter supply. • Liquidity has halved: From 153 sales per year during the

peak years to under 90 in 2024.

2. Peak Activity Years • Stability is high: Despite fewer sales, prices have not

• 2013–2014: Sales peaked, with 2013 being the collapsed entirely, showing the estate’s long-term

standout year. resilience and prestige positioning.

- This period coincided with post-2008 recovery • Supply is tight: With fewer sales, buyers often face

in property markets, strong demand for estate limited choice. Sellers with well-prepared, realistically

living, and relative affordability compared to priced properties have an advantage.

today’s replacement building costs.

- These years mark the highest liquidity period 7. Key Takeaways for Sellers

for Silver Lakes, when stock moved quickly and • Expect longer marketing periods compared to the early

buyer demand was at its strongest. 2010s.

• Differentiate your property: upgraded finishes, solar/

Implication: Properties listed in this cycle enjoyed inverter systems, modern kitchens, and entertainment

faster sales and greater competition. This era set spaces significantly improve sell ability.

benchmark prices for later years. • Price smartly: Overpricing in today’s low-volume

environment risks stagnation; well-priced properties still

3. Decline and Stabilisation (2016–2020) attract serious buyers.

• After 2015, sales volumes declined steadily, • Timing matters: Align listings with high-activity months

dropping closer to 91 sales per year. (Feb–May, Aug–Oct) to maximise exposure.

• Causes include:

- National economic slowdown and tighter credit ✅ Conclusion:

conditions. Since 2008, annual sales in Silver Lakes Golf Estate have

- Owners holding properties longer, reducing shifted from a high-volume, growth-driven cycle to a

resale frequency. low-volume, high-value maturity cycle. The market

- Price resistance in higher brackets (R6m+), remains resilient, but unit sales for 2023/2024 were at a

limiting turnover. lowest point, reflecting both economic conditions and

reduced turnover in a settled, prestigious estate. Sellers

Implication: While demand softened, values should be strategic in pricing and marketing to capture

remained resilient due to the estate’s desirability. the limited but motivated buyer pool.

Sellers, however, faced longer marketing times.

Article compiled by Martin Hayward 083 452 5599

4. Pandemic and Recovery (2020–2022)

• 2020: Sales volumes dipped due to lockdown

Looking to Sell or Simply Curious About Your Home’s Value?

disruptions and uncertainty.

If you’re considering selling or would just like to understand

• 2021–2022: Temporary rebound as pent-up

demand and historically low interest rates boosted where your property stands in today’s market, I’d be

buyer activity. delighted to assist. Contact me for a free, no-obligation

• This was in line with broader South African estate

market analysis or even just a friendly discussion about the

living trends: security, lifestyle, and work-from-

home adaptability became priorities. latest trends in Silver Lakes Golf Estate. With years of local

expertise and a data-driven approach, I can provide you with

Implication: This window created opportunities for

clear insights and guidance tailored to your needs.

sellers who capitalised on post-lockdown demand.

Live the life, love the home www.ikonic.co.za