Page 29 - Energize December 2022

P. 29

TECHNICAL

Towards a 100% renewable

energy future

Information from Wartsila

he global energy market is past 20 years, the cost per kW of wind power plants has decreased by 40% and solar

constantly evolving. Current has dropped by 90%. Currently, wind and solar attribute to approximately 1100 GW of

Tmarket trends show the energy electricity globally which forecasts indicate will rise to 2000 GW in 2024. Similar trends in

landscape is in transition towards global energy storage deployments show an increase from 139 MW in 2012 to 1173 MW

more flexible energy systems with a in 2017.

rapidly increasing share of renewable Annual global installations of renewable energy capacity are also steadily increasing.

energy, declining inflexible baseload In 2017, 175 GW of new renewable energy was installed globally, the highest year on

generation and wider applications of record.

storage technology. The declining costs This includes 98 GW of solar PV which is expected to rise to 100 GW in 2018. This

of renewables have begun to reduce new industry transformation and global advancement towards renewable generation has made

investments into coal and other inflexible it more difficult for existing inflexible baseload power plants, such as coal and nuclear,

baseload technologies; a transition which to efficiently provide solutions for customers. Since investments define and dictates a

will eventually cause renewables to company’s strategy for the future, the existing business model is shifting from the era where

become the new baseload. In 2017 itself, centralised large units benefited from economies of scale. Moreover, as investments in

14% of electricity generation worldwide new intermittent energy technology grow and prices for renewables reach a tipping point,

was attributed to wind and solar. utilities are starting to change their portfolios to involve more renewables and flexible

generation. Flexible solutions like engine power plants and energy storage are the key to

The renewable revolution providing the needed reliability and ensuring the affordable cost of power systems.

In recent years, market trends show a Today, large markets such as the US, the UK and specific regions in Central Europe

steady decline in the price of renewable exist for stand-alone energy storage due to high fuel costs, and the levelised cost of

energy in the global power system. electricity (LCOE) of renewables set to fall below those of conventional coal and gas by

Investments into new inflexible baseload 2040. This will lead to a tipping point, where new build renewables will become cheaper

generation are also on the decline and than new build combined cycle gas turbine (CCGT) or coal baseload plants and cause

price performance data shows the increasing focus on new investments into renewables. This tipping point will arrive at

cost competitiveness of wind and solar different times in different countries – in China, onshore wind is now beginning to gain

is rapidly increasing as compared to a competitive advantage over coal however in the US, the best-in-class on shore wind is

traditional thermal generation. In the already cheaper than the new build CCGT.

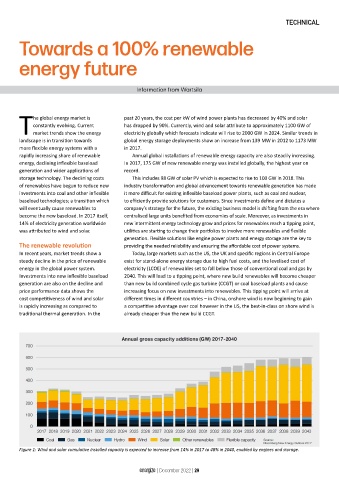

Figure 1: Wind and solar cumulative installed capacity is expected to increase from 14% in 2017 to 48% in 2040, enabled by engines and storage.

energize | December 2022 | 29