Page 9 - EngineerIt August 2021

P. 9

ICT FINANCE

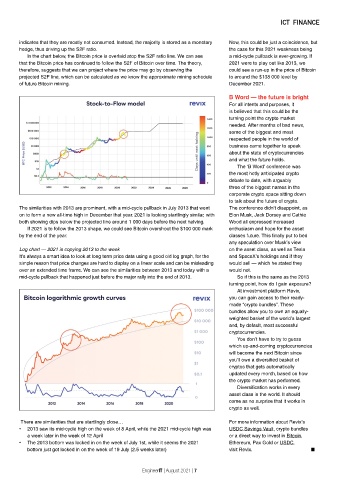

indicates that they are mostly not consumed. Instead, the majority is stored as a monetary Now, this could be just a coincidence, but

hedge, thus driving up the S2F ratio. the case for this 2021 weakness being

In the chart below, the Bitcoin price is overlaid atop the S2F ratio line. We can see a mid-cycle pullback is ever-growing. If

that the Bitcoin price has continued to follow the S2F of Bitcoin over time. The theory, 2021 were to play out like 2013, we

therefore, suggests that we can project where the price may go by observing the could see a run-up in the price of Bitcoin

projected S2F line, which can be calculated as we know the approximate mining schedule to around the $138 000 level by

of future Bitcoin mining. December 2021.

B Word – the future is bright

For all intents and purposes, it

is believed that this could be the

turning point the crypto market

needed. After months of bad news,

some of the biggest and most

respected people in the world of

business came together to speak

about the state of cryptocurrencies

and what the future holds.

The ‘B Word’ conference was

the most hotly anticipated crypto

debate to date, with arguably

three of the biggest names in the

corporate crypto space sitting down

to talk about the future of crypto.

The similarities with 2013 are prominent, with a mid-cycle pullback in July 2013 that went The conference didn’t disappoint, as

on to form a new all-time high in December that year. 2021 is looking startlingly similar, with Elon Musk, Jack Dorsey and Cathie

both showing dips below the projected line around 1 000 days before the next halving. Wood all expressed increased

If 2021 is to follow the 2013 shape, we could see Bitcoin overshoot the $100 000 mark enthusiasm and hope for the asset

by the end of the year. classes future. This finally put to bed

any speculation over Musk’s view

Log chart – 2021 is copying 2013 to the week on the asset class, as well as Tesla

It’s always a smart idea to look at long term price data using a good old log graph, for the and SpaceX’s holdings and if they

simple reason that price changes are hard to display on a linear scale and can be misleading would sell – which he stated they

over an extended time frame. We can see the similarities between 2013 and today with a would not.

mid-cycle pullback that happened just before the major rally into the end of 2013. So if this is the same as the 2013

turning point, how do I gain exposure?

At investment platform Revix,

you can gain access to their ready-

made “crypto bundles”. These

bundles allow you to own an equally-

weighted basket of the world’s largest

and, by default, most successful

cryptocurrencies.

You don’t have to try to guess

which up-and-coming cryptocurrencies

will become the next Bitcoin since

you’ll own a diversified basket of

cryptos that gets automatically

updated every month, based on how

the crypto market has performed.

Diversification works in every

asset class in the world. It should

come as no surprise that it works in

crypto as well.

There are similarities that are startlingly close… For more information about Revix’s

• 2013 saw its mid-cycle high on the week of 8 April, while the 2021 mid-cycle high was USDC Savings Vault, crypto bundles

a week later in the week of 12 April or a direct way to invest in Bitcoin,

• The 2013 bottom was locked in on the week of July 1st, while it seems the 2021 Ethereum, Pax Gold or USDC,

bottom just got locked in on the week of 19 July (2.5 weeks later) visit Revix. n

EngineerIT | August 2021 | 7