Page 68 - Energize July 2022

P. 68

TECHNICAL

Lead-acid batteries are not going

away – A technical comparison of

lead-acid and Li-ion batteries

by Michael Schiemann, BAE Batterien Germany; and Chris Searles, BAE Batteries USA

ith the introduction of Li-ion battery manufacturers focus on replacing legacy lead-acid batteries in applications

lithium-ion (Li-ion) technology where lead-acid batteries have traditionally dominated. The question is, will Li-ion

1

Winto the market by Sony in the technology dramatically change the industrial stationary market as we know it, or will the

early 1990s, Li-ion technology is increasingly lead-acid battery remain attractive?

being looked at as a most desirable

energy storage technology for small and Standby applications

midsize standby power and energy storage If we consider the primary characteristics of Li-ion technology, on the surface it appears that

applications. The progress with lithium was the technology can be a serious alternative for stationary standby battery markets, especially

initially driven by consumer electronics and in the traditional stationary battery applications which provide standby backup power in

has now dramatically changed the market substations, power generation plants, UPS data centres and telecommunications. This begs

with respect to “mobile” batteries like NiCd the question: are the primary characteristics of Li-ion technology really essential or required

or NiMH. for standby battery operation?

Based on the primary positive Major electric utilities, especially investor-owned utilities or utilities connected to the

characteristics of Li-ion technology Bulk Electric System (BES) in North America which are governed by certain NERC mandates,

that provide high energy content and have typically used vented-lead-acid (VLA) standby batteries for protection and control

good cycle performance, along with the switchgear, emergency lighting, SCADA and other related applications. They use both VLA

progress of material and production and the valve-regulated-lead-acid (VRLA) batteries for the uninterruptible power supplies

technologies, lithium-ion batteries have (UPS) in their offices and private telecommunications networks.

been successfully introduced into the In a UPS application the battery delivers anywhere from 5 to 1000 kW of power at a

market for Battery Electric Vehicle (BEV) battery voltage of 380 to 550 V with a typical discharge/bridging time of 5 to 30 minutes.

or Plug-in Hybrid Electric Vehicle (PHEV) The applied capacity of the battery can be anywhere from 7 to >1500 Ah depending on

applications. specification requirements.

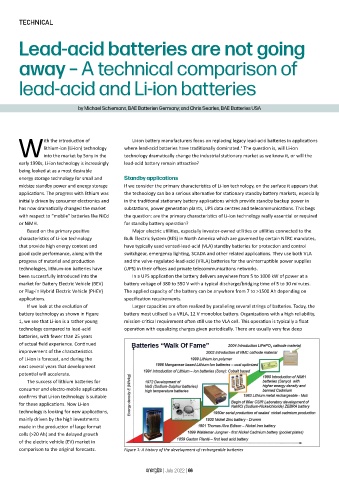

If we look at the evolution of Larger capacities are often realized by paralleling several strings of batteries. Today, the

battery technology as shown in Figure battery most utilised is a VRLA, 12 V monobloc battery. Organizations with a high reliability,

1, we see that Li-ion is a rather young mission-critical requirement often still use the VLA cell. This operation is typically a float

technology compared to lead-acid operation with equalizing charges given periodically. There are usually very few deep

batteries, with fewer than 25 years

of actual field experience. Continued

improvement of the characteristics

of Li-ion is forecast, and during the

next several years that development

potential will accelerate.

The success of lithium batteries for

consumer and electro-mobile applications

confirms that Li-ion technology is suitable

for these applications. Now Li-ion

technology is looking for new applications,

mainly driven by the high investments

made in the production of large format

cells (>20 Ah) and the delayed growth

of the electric vehicle (EV) market in

comparison to the original forecasts. Figure 1: A history of the development of rechargeable batteries

energize | July 2022 | 66