Page 17 - • waterfall_9_Aug2020_v3.indd

P. 17

WHY YOU SHOULD

AVOID RAIDING

YOUR RETIREMENT

FUND IN A CRISIS

M lifetimes. Life is, after all, riddled with uncertainties, as is evident

By Gerhardt Meyer CFP®, ost of us will experience some unforeseeable crisis during our

Head of Technical Support, PSG Wealth from the current pandemic. If you should lose your job or have

your income reduced considerably, how do you plan on making

up the shortfall? Without an emergency fund or access to investments,

you might be eyeing your retirement savings to close the gap. But there

are serious pitfalls to raiding your retirement fund prematurely.

Here is what you need to consider.

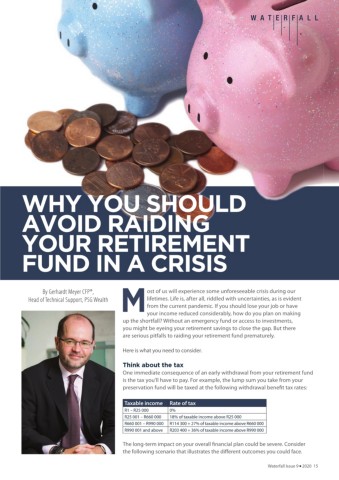

Think about the tax

One immediate consequence of an early withdrawal from your retirement fund

is the tax you’ll have to pay. For example, the lump sum you take from your

preservation fund will be taxed at the following withdrawal benefit tax rates:

Taxable income Rate of tax

R1 – R25 000 0%

R25 001 – R660 000 18% of taxable income above R25 000

R660 001 – R990 000 R114 300 + 27% of taxable income above R660 000

R990 001 and above R203 400 + 36% of taxable income above R990 000

The long-term impact on your overall financial plan could be severe. Consider

the following scenario that illustrates the different outcomes you could face.

Waterfall Issue 9 2020 15